Global Systemic Crisis 2017-2021 – A phase of chaotic recomposition of the World: national re-landing, crash or rebound?

This expression “chaotic recomposition” seems best to summarise the phase where we currently are with regards to the development of the crisis, a step indicated here as extending over four years and which will include distinct progression phases. It is quite clear that efforts to reorganise the world on a transnational logic have all failed in this first half of 2017: . The inter-or supranational system built in the 20th century (UN, IMF, WB, NATO, etc.) failed to adapt and to oversee the new multipolar geopolitical configuration of the beginning of the 21st century. It is now in full slump, in all its forms, regions included (EU, Mercosur...

(Read the public announcement for free)

This expression “chaotic recomposition” seems best to summarise the phase where we currently are with regards to the development of the crisis, a step indicated here as extending over four years and which will include distinct progression phases. It is quite clear that efforts to reorganise the world on a transnational logic have all failed in this first half of 2017: . The inter-or supranational system built in the 20th century (UN, IMF, WB, NATO, etc.) failed to adapt and to oversee the new multipolar geopolitical configuration of the beginning of the 21st century. It is now in full slump, in all its forms, regions included (EU, Mercosur...

(Read the public announcement for free)

Other chapters of this article:

-Stylistic exercise: what might the Middle East look like in 2021?

-Latin America: the end of the Bolivarian left wings

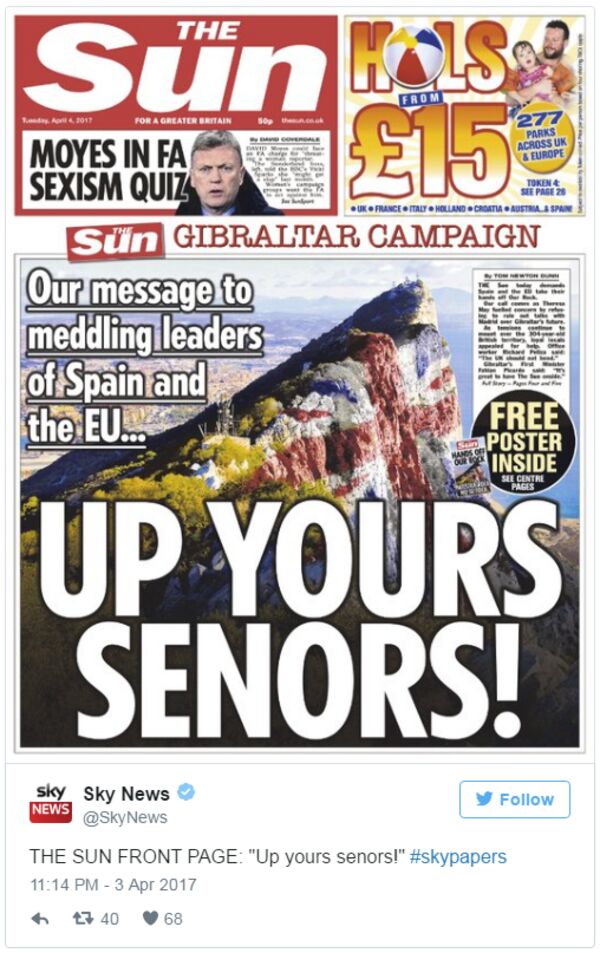

-European Union / United Kingdom: same challenge of union reinvention

-French elections: everything changes!

-Stylistic exercise: what might the Middle East look like in 2021?

-Latin America: the end of the Bolivarian left wings

-European Union / United Kingdom: same challenge of union reinvention

-French elections: everything changes!

______________________________

Euro governance / Horizon 2020: The inevitable evolution of the ECB’s unique mandate

The financial crisis followed by the debt crisis has led to a substantial change in the mandate of the European Central Bank (ECB) and to more political provisions. The ECB has acquired implicit mandates to safeguard the euro but also an economic policy which all go far beyond the original objective of price stability. The current ambiguity can not last and the enlargement of the mandate could be one of the great European debates of the early 2020s…

(Read more in the GEAB 114 / Subscribe)

The financial crisis followed by the debt crisis has led to a substantial change in the mandate of the European Central Bank (ECB) and to more political provisions. The ECB has acquired implicit mandates to safeguard the euro but also an economic policy which all go far beyond the original objective of price stability. The current ambiguity can not last and the enlargement of the mandate could be one of the great European debates of the early 2020s…

(Read more in the GEAB 114 / Subscribe)

Other chapters of this article:

-The successful decade of the original mandate

-A new mandate: guaranteeing the existence of the euro zone

-The ECB, the manager of the economic policy of the euro area

-A rigid and obsolete institutional framework

-A desire for non action

-The key to the mandate change -Real risks of non-action

-The emergence of conditions for change

-The successful decade of the original mandate

-A new mandate: guaranteeing the existence of the euro zone

-The ECB, the manager of the economic policy of the euro area

-A rigid and obsolete institutional framework

-A desire for non action

-The key to the mandate change -Real risks of non-action

-The emergence of conditions for change

______________________________

2017-2020 / Euro crisis: A compromise solution for a non-democratic Euroland

In the GEAB no 109 of November 2016 we wondered if “the euro would survive beyond the year 2017”. Five months later, we wish to deepen and complete our analysis. One reason for the weakness of the euro comes from the political anaemia of the euro zone, which is ultimately far too un-integrated to afford a single currency, or (the other side of the coin, if we may say it this way) afford misconceptions around this single currency for a heterogeneous zone…

(Read more in the GEAB 114 / Subscribe)

In the GEAB no 109 of November 2016 we wondered if “the euro would survive beyond the year 2017”. Five months later, we wish to deepen and complete our analysis. One reason for the weakness of the euro comes from the political anaemia of the euro zone, which is ultimately far too un-integrated to afford a single currency, or (the other side of the coin, if we may say it this way) afford misconceptions around this single currency for a heterogeneous zone…

(Read more in the GEAB 114 / Subscribe)

Other chapters of this article:

-Euro currency: design problems

-Why the euro will survive

-A reform to get everyone around the table to agree

-2017-2020, the window of opportunities

-Euro currency: design problems

-Why the euro will survive

-A reform to get everyone around the table to agree

-2017-2020, the window of opportunities

______________________________

Investments, trends and recommendations : Oil: proud of our nose!

We go back to our last month recommendation on oil. As a reminder, last 14-15 March, oil prices plunged at the announcement of a flood of oil from American shale, drowning efforts to reduce production of OPEC and its partners, and putting into perspective a Saudi stop to the agreement. Our recommendation was to warn you against these announcements, drawing your attention to unimpressive shale production charts and, above all, to an increase in Saudi production, in fact linked to an increase in inventories, which is what suggested the fear of tensions, and hence a short-term recovery in prices...

(Read more in the GEAB 114 / Subscribe)

We go back to our last month recommendation on oil. As a reminder, last 14-15 March, oil prices plunged at the announcement of a flood of oil from American shale, drowning efforts to reduce production of OPEC and its partners, and putting into perspective a Saudi stop to the agreement. Our recommendation was to warn you against these announcements, drawing your attention to unimpressive shale production charts and, above all, to an increase in Saudi production, in fact linked to an increase in inventories, which is what suggested the fear of tensions, and hence a short-term recovery in prices...

(Read more in the GEAB 114 / Subscribe)