When China invests in infrastructure throughout the world, it’s partly to

get rid of its dollars. But then they pass into the hands of large companies in

the infrastructure field, which in turn accumulate dollar reserves. If their

treasury is run in dollars, the fall which we anticipate above will cause them

to lose a great deal of money. Domestic SMEs are a priori much less sensitive to

this risk and accordingly we favour them in terms of investment strategy. We

reiterate our recommendation for European businesses trading abroad to invoice

their services in Euros in order to free themselves from exchange rate risk.

It’s simpler and especially safer than to rely on financial products which make

it possible to cover this risk: who will pay out on these options or other

derivatives in the event of a world financial shock?

Germany, France and nine other EU countries approved tax on financial

transactions

The Times reported that EU finance ministers gave their blessing to the

scheme, which will apply to anyone in the 11 countries who makes a bond or share

trade or bets on the market using derivatives...

Moscow Stock Exchange announces domestic IPO

Russia’s leading stock exchange will hold its initial public offering

(IPO) on its own trading platform. The shares will only trade in Moscow. The

size and time of the flotation hasn’t been announced...

A recommendation to Euro-BRICS leaders: Organize a mini Euro-BRICS Summit,

ahead of the St Petersburg G20, in order to develop common strategic positions

to exit the crisis and bring global governance into the XXI° century

In 2013, the world realizes that the U.S. debt that weighs so heavily on

the global economy, has no solution: its astronomical size and the extreme

weakness of economic fundamentals in the United States leave nothing more than

to predict the collapse of the international currency as the inevitable

consequence of and solution to the U.S. debt crisis. Thus the global crisis is

about to experience a new dramatic development. The question is: Is the world

prepared to bear such a shock?

Goldman Overcomes Its Latest Headache

It was an American success story gone horribly wrong. A married couple

started a software business in their Massachusetts home and eventually sold it

to a Belgian company for $580 million...

Yen Meddling—What Has Japan Started?

Japan's new government certainly isn't mincing its words about wanting a

weaker yen. Deputy Economy Minister Yasutoshi Nishimura said on Thursday the

yen's fall was not over and a move to 100 per dollar would not be a concern – a

comment that sent the yen tumbling 2 percent overnight with the currency a 2-1/2

year low at about 90.65 to the greenback on Friday...

U.K. Economy Shrinks More Than Forecast

Britain’s economy shrank more than forecast in the fourth quarter as the

boost from the Olympic Games unwound and oil and gas output plunged, leaving the

country on the brink of an unprecedented triple-dip recession...

L'Afrique du Sud invite l'UA à participer au sommet des BRICS

Le gouvernement sud- africain a déclaré jeudi avoir, pour la première

fois, invité l'Union africaine (UA) et les économies régionales africaines au

5ème sommet des BRICS afin de promouvoir l'intégration régionale. ..

ECB Says Banks to Make 137 Billion-Euro Loan Repayment Next Week

The European Central Bank said 278 banks will hand back 137.2 billion

euros ($184.4 billion) of its three-year loans next week at the first

opportunity for early repayment. That compares with the median forecast of 84

billion euros in a Bloomberg News survey of economists...

Why were German soldiers 'attacked' in Turkey?

The recent attack on German soldiers by a group of Turkish nationalists in

Iskenderun reveals the distrust some Turks feel toward the West, NATO and the

US. It seems likely that more protests will follow...

Monti attacks 'short-termism' in EU politics

Italy's outgoing Prime Minister Mario Monti on Wednesday (23 January)

criticised fellow EU leaders for the way they dealt with the euro crisis and

said corporations are blocking reforms in order to promote "vested interests" in

Europe...

Bundesbank chief warns that central banks are being pushed into currency

war

Loading central banks with more tasks and pressing them to pursue more

aggressive monetary policies could risk a round of competitive devaluations,

European Central Bank policymaker Jens Weidmann said on Monday, citing pressure

on the Bank of Japan...

Nos très “chers” alliés…

L’aide logistique de certains alliés est mise en avant. Mais elle n’est

pas gratuite. A l’envoi de C17 britanniques ou américains devrait succéder la

facture ensuite, selon les informations reçues par B2. Les Américains ont ainsi

prévenu les Français, l’heure de vol sera facturée...

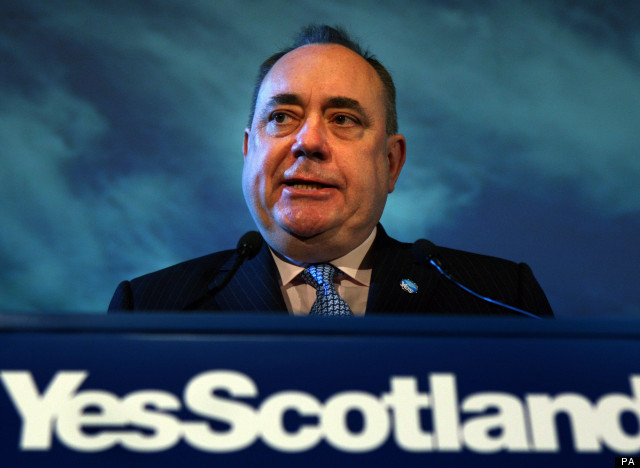

Alex Salmond says EU speech ‘completely changes’ independence vote

“It is now clear the persistent undercurrent of Tory Euroscepticism poses

the biggest threat to Scotland’s position in the EU and has now helped to hole

below the waterline the baseless scaremongering of Alistair Darling and the rest

of the No campaign.”...

Les raisons de la surprise Yaïr Lapid aux législatives israéliennes

eliennes_b5152736.html?&start=20

Le score de Yaïr Lapid est la grosse surprise de ces élections. Il

remporte 19 sièges, alors que les derniers sondages le créditaient de 12 sièges.

Il a siphonné les voix du parti centriste Kadima ("En avant") de Shaul Mofaz et

du parti Hatnoua ("Le Mouvement") de Tzipi Livni, ancienne de Kadima...

Otro supremazo: la tercera sala de la Corte ordenó a la SBIF revelar las

fiscalizaciones que realiza a la banca y dispuso que la SVS publique los nombres

de funcionarios que tienen acciones de empresas reguladas...