Pensions: capital destroyed by the financial crisis and distribution

reduced by austerity, falling real estate and rising inflation … cuts are the

order of the day

Due to the financial crisis, portfolio asset devaluations and their stock

exchange losses, pension funds are reducing the size of annuities paid to

pensioners who thought they were guaranteed decent incomes in their retirement.

Governments are increasing measures to reduce the size of pension, either by

increasing the compulsory contribution period, or by quite simply reducing their

monthly payment. And the very low interest rate policies are ‘killing’ pension

fund incomes . On the chart below, note that between 2008 and 2012 British

pensioners have already seen their incomes cut by almost 20%; and the same

phenomenon is at work throughout the Western world... LEAP/E2020 -

Excerpt GEAB N°65 (May 2012)

Audio - Franck Biancheri on Sovereign Debt Crisis and Europe’s Future

FSN Foreign Correspondent Erik Townsend interviews Franck Biancheri,

founder of European think tank LEAP/E2020 on the causes of the sovereign debt

crisis, Europe’s future, pending war between Iran, Israel and the United States,

and common... Financial Sense

German trade activities slow down

German exports and imports have contracted amid the eurozone debt crisis

and a worsening trade environment globally. On a year-on-year basis, though,

things don't look that gloomy at all for Europe's biggest economy. Deutsche Welle

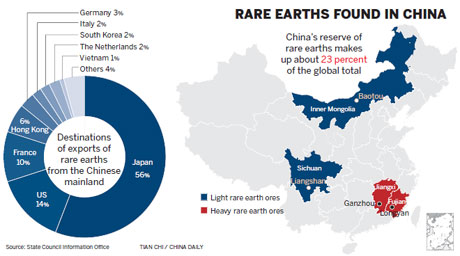

System to price rare earths

China is to set up a national pricing system for rare earth metals within

the next month, in addition to its new trading platform, to further regulate the

industry and strengthen its control of the resources, essential materials in

consumer electronics and other high-tech goods. China

Daily

The European Central Bank's Discreet Help for Greece

The European Central Bank is now taking risky measures to help save Athens

from its acute financial emergency. Increasingly, euro-zone leaders are pushing

the dirty work on the ECB. In the end, though, they will likely have no choice

but to pay Greece the next tranche of its bailout package. Der

Spiegel

George Osborne told his lending scheme boosts banks - not the

economy

Four years after the global financial crisis, the British economy remains

flat on its back, the Bank of England confirmed yesterday. The Bank also warned

that George Osborne's new scheme to kickstart lending to credit-starved

households and businesses might end up boosting bank profits rather than helping

the economy. The

Independent

German opposition: only eurobonds can save the single currency

The German opposition has endorsed plans for a national referendum on

creating a full-blown fiscal Union. The leader of the centre-left SPD party,

Sigmar Gabriel, rolled out the proposals at a small press conference in Berlin

on Monday (6 August). He said the euro can only be saved by pooling debt and

sovereignty. EUObserver

Bank of England sharply cuts growth forecast

In its quarterly Inflation Report, the BoE said that growth in two years

time was likely to be around 2pc a year, down sharply from the forecast of

2.67pc just three months ago. This marks a break with previous BoE forecasts,

which have usually shown strong rebounds in growth, even after short-term

weakness. The

Telegraph

L'assurance-vie menacée d'une nouvelle baisse de ses rendements

Bien qu'attendus en hausse en début d'année, les rendements des contrats

d'assurance-vie en euros (à capital garanti) pourraient de nouveau s'afficher en

baisse en 2012, flirtant désormais avec le taux du Livret A. Or, le contexte est

déjà difficile pour l'assurance-vie, qui a connu une décollecte nette (retraits

supérieurs aux versements) lors de 10 des 11 derniers mois – du jamais

vu. Le

Monde

Permanent jobs fall for second month

The number of people placed in permanent jobs has fallen for the second

month in a row, suggesting that employers are putting recruitment decisions on

hold until after the Olympics, according to new research. A report by KPMG and

the Recruitment and Employment Confederation (REC) said there was still a "high

degree of uncertainty" among employers. The

Independent

Japan July 1st 20-Day Exports -2.4%, Trade Deficit Y580.0 Bln

Japan's exports fell in the first 20 days of July from a year earlier,

when shipments were recovering from the major supply chain breakdown caused by

the March 2011 earthquake disaster, data released by the Ministry of Finance

showed on Wednesday. Deutsche

Börse

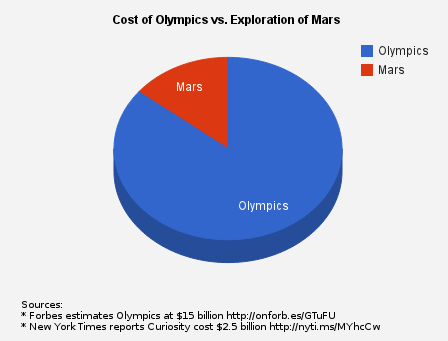

The cost of the Olympics vs. the cost of landing Curiosity on Mars : A

tragedy of priorities

The most appalling infographic you’ll see today compares the cost of the

Olympics vs. the cost of landing Curiosity on Mars. And yet, the future of space

exploration is more precarious than ever... Explore

Eurosceptics argue that EU integration undermines national identities and

cultures. But is there such thing as a common “European identity”? In its

continuing series on euromyths, De Groene Amsterdammer tries to sound out what

Europeans think. PressEurop

Le jeu trouble de Reuters dans la crise de la zone euro (encore et

toujours)

Vendredi, 16 h 33. Une dépêche de l’agence anglo-saxonne Reuters, fil

anglais, titre : « l’Espagne discute d’un plan de sauvetage global » de 300

milliards d’euros. Gasp ! Quel scoop ! Après la Grèce, l’Irlande, le Portugal,

l’Espagne (et Chypre…). Il ne manque plus que l’Italie pour que tous les PIIGS

soient au tapis. Libération

Are US Sanctions Against Iran Working?

The U.S. State Department has been adamant that the economic pressure it

has been putting on Iran will force that country to come to the negotiation

table and abandon or modify its nuclear ambitions. Having said that, it looks as

if Tehran is not serious about negotiating until after the U.S. elections in

November. CNBC

La province orientale de l’Arabie Saoudite en ébullition

Le vendredi 3 août au soir, l’est du royaume saoudien a une nouvelle fois

été le théâtre de violences. Deux personnes, dont un policier, ont été tuées

lors d'une attaque contre une patrouille de police. Depuis janvier 2011,

l’Arabie Saoudite sunnite tente, tant bien que mal, de mater le soulèvement de

la minorité chiite majoritaire dans l’est du pays. RFI

-------------------------------------------------

This special Press Review reviews articles from the French and

Engligh-speaking international online media relating to the unfolding global

crisis.

It is delivered freely on a weekly basis to 60,000 recipients worldwide.

Subscription / Contact: centre@europe2020.org

It is delivered freely on a weekly basis to 60,000 recipients worldwide.

Subscription / Contact: centre@europe2020.org